Swimming in Stable Waters: Examining the Diverse World of Stablecoins

Stablecoins offer price stability amid crypto volatility by pegging to fiat currency. This article explores their emergence, growth, types like fiat-collateralized and algorithmic, key use cases in trading and...

Stablecoins are a fascinating phenomenon in the financial world, as they emerged mostly under the radar, until they suddenly 'broke out' for the outside world. This article explores the experimentation of this financial instrument, its emergence, its growth, and its potential future.

A Stablecoin

We know stablecoins as a digital currency that aims to provide price stability amid the volatility of the cryptocurrency market. It attempts to maintain a constant value, in most cases pegged to a fiat currency like the US dollar. How stablecoins achieve their goal of a 1:1 peg will differ based on their design.

In the earlier days of cryptocurrency (2015), crypto exchange Bitfinex, was experiencing difficulty with banking so they decided to ease dollar transactions with their clients by creating stablecoins, thus transacting outside the highly politicized and restricted domestic banking sector. And so began the journey towards popularity for our stablecoins, where their usage became increasingly widespread.

3 Main Categories of Stablecoins

Today we know three primary mechanisms used for the creation of stablecoins;

#1 Fiat-Collateralized Stablecoins

This is the most common type, the fiat-backed stablecoins which are collateralized with reserves of fiat currency, but not limited. The most popular examples include Tether - USDT and USD Coin - USDC. In this case, the issuers of the stablecoin must hold sufficient cash or cash equivalents in order to maintain the 1:1 peg of their issued stablecoin. Whether this is always as transparent as many should like is open to debate.

#2 Crypto-Collateralized Stablecoins

The second category of stablecoins is the crypto-collateralized stablecoins that use other cryptocurrencies as their backing for maintaining a stable peg. Their peg relies on over-collateralization, which means they require more crypto deposited than the stablecoins they minted. Of all known crypto-collateralized stablecoins we recognize MakerDAO's - DAI as the largest crypto-backed stablecoin.

#3 Algorithmic Stablecoins

Thirdly, there are the algorithmic stablecoins that aim for decentralization using built-in protocols to stabilize value. Knowing our crypto history, we heard many devastating stories where the inherent flaws made them to lose their peg, with the most notorious one as UST.

Any Other Types?

Yes, there are some stablecoins that use hybrid or unique models, as we have to mention that cryptocurrency can be seen as a big experiment where many want to improve the underlying stablecoin mechanisms.

A few examples are:

- Partially algorithmic coins like FRAX

- Asset-pegged coins like PAX Gold (gold)

- A delta-neutral position (50% short ETH, 50% long stETH) that backs USDe in development by Ethena

We see that all designs known to crypto-man have yet to find an optimal balance across decentralization, stability, and efficiency. We know that many will lose their pegs in the process but are sure that the quest for the "perfect" stablecoin will continue as long as the internet exists.

Key Use Cases

If we look at the fundamentals of stable coins it is relatively simple. When you give a stablecoin issuer one US dollar, they will mint you one stablecoin. But beyond this utter simple transaction, what are stablecoins used for and why is this already proven a game changer for many?

Traditionally, stablecoins have been used predominantly in crypto trading where traders who don’t want to trade into their own local currency can seek the tranquility of stability in the stablecoin markets, remember that most derivatives are traded on stablecoin markets.

Secondly, the Decentralized Finance (DeFi) ecosystem where users can or could farm some yield was mostly driven by Ethereum and its most notorious stablecoins like USDC and USDT. Later BUSD and others were added to the ‘decentralized’ mix where centralized parties issued big chunks of liquidity.

All this is good and well, but a third major use case has emerged over time, which involves utilizing stable coins in regions where people don't have access to a stable currency due to issues with their home currency inflating away like water on a hot plate.

Their (financial) freedom is taken away by financial mismanagement of their government or policymakers and their grim future is somewhat being brightened by the ability to make use of cryptocurrency in a stable form - stablecoins. This is especially important in hyperinflation countries…

The ability to move money freely without restrictions is one of the key advantages of stablecoins, and this is right at the heart of the crypto movement of being your own bank and finding an alternative to the system, so be it a ‘new’ system.

Main Benefits Driving Stablecoin Adoption

Now that the key use cases are known, we have to look at some of the features of stablecoins. We recognize four main ones;

- Speed - Stablecoin transactions settle nearly instantly, compared to days with traditional banking. Goodbye, only weekday transactions, and hello 24/7 real-time payments.

- Lower fees - By removing intermediaries, stablecoin fees are fractions of traditional wire transfers or remittances, this will depend heavily on the choosing of the blockchain ofcourse.

- Accessibility - Anyone can access stablecoins globally by simply downloading a digital wallet. Ofcourse, there will be restrictions in some parts of the world, but generally, anyone can access it without geographic restrictions.

- Stability - The pegging to the chosen fiat currencies reduces volatility risk compared to other cryptocurrencies that see extreme highs and lows.

Regulatory Risk

Knowing that big stablecoin issuers pull at many strings, we see that regulatory risk is a significant concern for fiat-backed stablecoins. Not only do they mirror some of the biggest currencies such as; USD and EUR, but they also form an alternative to banking as a whole.

For stablecoins, managing risk involves ensuring that the coin is backed one-for-one and that the collateral is secure. The downfall of Terra Luna and UST alarmed many governments after their people lost life savings in the disaster and ripple effects that followed.

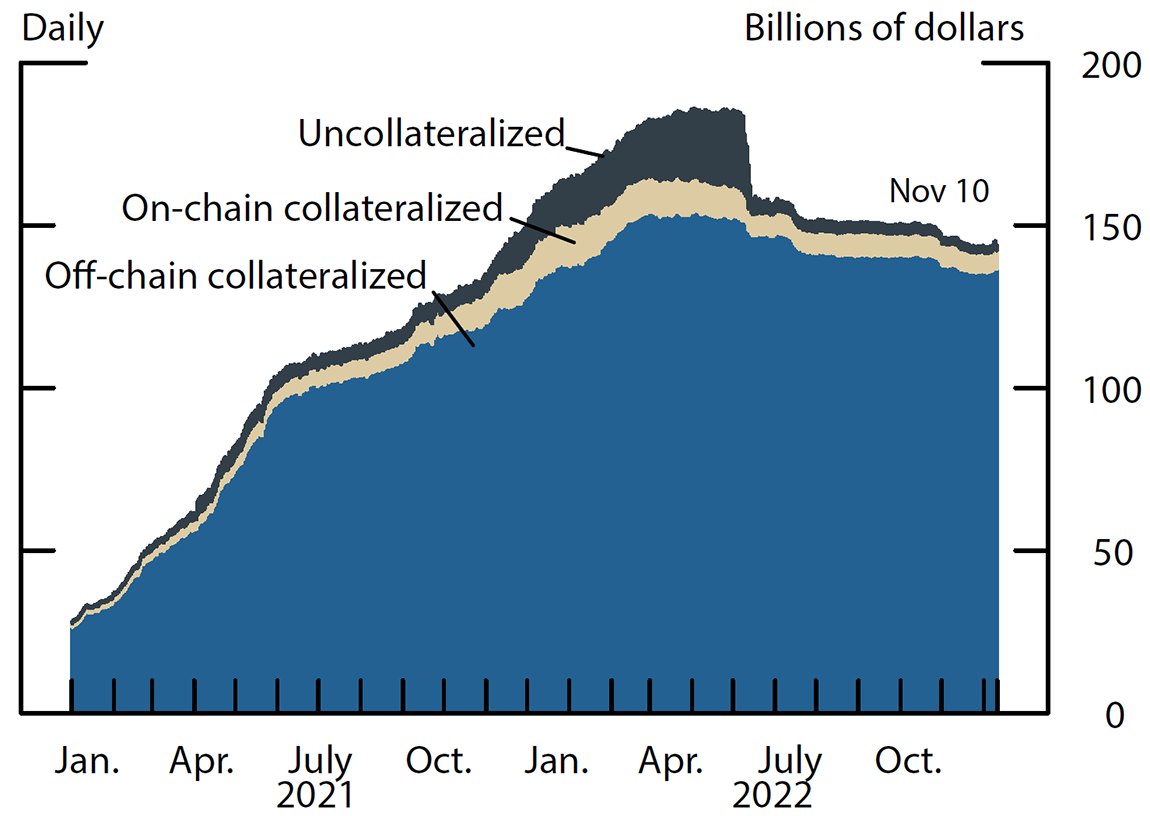

Prudent as regulators are, stablecoins need to interact with regulators across different jurisdictions, and this can be said to be a challenge, to say the least. We saw that the U.S. financial policy has significantly influenced the stablecoin market. The market cap of onshore stables (U.S. domiciled stablecoins) has seen a precipitous decline following the U.S.'s "attack" and crackdown. If deemed securities, major restrictions could apply around issuance, redemption, reserves, disclosures, etc.

In contrast, offshore stablecoins have benefited immensely. This shift hasn't reduced the overall quantity of stablecoins; instead, it has advantaged offshore stablecoins while disadvantaged U.S. ones.

Response of Other Countries

However, the U.S. doesn’t control the world…yet, and other countries are embracing stablecoins. For instance, Singapore recently finalized a regulatory framework for stablecoins, including the use of dollars.

Japan lifted its ban on foreign-issued stablecoins, and Hong Kong allowed the issuance of a Hong Kong dollar stablecoin.

As we see, when one leads many will follow, so numerous new jurisdictions have embraced stablecoins and their tokenized treasuries.

These also include the British Virgin Islands, Bermuda, Switzerland, Germany, the Netherlands, and some offshore locations. These jurisdictions see the U.S.'s failure as their opportunity to shine, which inevitably results in capital flight and the global exportation of dollars and tokenized treasuries outside U.S. supervision.

Key Challenges Stablecoin Adoption

The first challenge is the one that is not only limited to the use of stablecoins but hits the whole of crypto. The user-friendliness and the ease of use. These are too complex for the average newbie and hopefully this will change over time when setting up wallets becomes as easy as ordering something online.

The second is the difficulty of getting money in and out of a stablecoin. The on and off-ramps are being deliberately blocked by the banking sector. That obviously sees a competitor in their stablecoins issuing colleagues.

The third is the complexity of transactions due to the numerous competing chains, there are many chains and not all are created equal. We can say that many stablecoin companies are working to address this issue with cross-chain transfer protocols and facilitate easy movement of money between different chains.

Future of Stablecoins

Just like the U.S. government's initial fear and eventual acceptance of Eurodollars, stablecoins may follow a similar path, according to Nic Carter. While they remain peripheral and somewhat feared by now, they could eventually become a mainstream digital currency, particularly as the world becomes more dependent on the digital economy.

Currently, the U.S. dollar is the unit that accounts for 99% of all stablecoins, a figure much higher than its share of international foreign currency reserves or international trade. This remarkable dollarization of stablecoins is predicted to continue, maintaining at least a 95% market share. If the dollar milkshake theory has its effect in the real world, it will do the same online.

The emergence of interest-bearing stablecoins is also expected. Currently, stablecoins generally don't pay interest, unless they are put to work, but this poses a significant opportunity cost. The rise of projects focusing on yield-bearing stablecoins points to a future where stablecoins could potentially attract new users who want to earn more easily than before.

The challenge for the crypto community is to continue integrating stablecoins into the global settlement infrastructure and create something so compelling that governments worldwide have no choice but to acknowledge these markets as legitimate.

Yes, stablecoin use cases are still just scratching the surface on a global level, but there is huge potential to expand these coins into business payments, merchant services, investing, lending, and more. We know how this is going to turn out…

Conclusion

It's clear that stablecoins which are put in more simple terms; digital dollars, and are often maintained by centralized or decentralized underlying models, are poised to play a significant role in the future of digital finance.

While many once mighty stablecoins have fallen, their models provide interesting lessons and challenge us to ensure the next ones are more reliable, user-friendly, and accessible to a broad range of users.

So that individuals in need and companies can recognize and integrate the stablecoin infrastructure, in order to unlock the next generation of instant, affordable financial services for people and businesses worldwide. Exciting unstable times ahead!

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: While every effort is made on this website to provide accurate information, any opinions expressed or information disseminated do not necessarily reflect the views of Bitfinity itself. The information provided here is for general informational purposes only and should not be considered as financial advice.

Comments ()