Bitfinity Weekly: So Long, 2023!

Welcome to Issue #86 of Bitfinity Weekly for our #BITFINIANS community. If this newsletter was forwarded to you, sign up here.

What's in Today's Email?

- Global Crypto News

- This Week in our Blog

- NFT Market Bytes

- Tweet of the Week

- Meme Time

- A Matter of Opinion

Global Crypto News

🔪 The Chopping Block: OKX, one of the largest crypto exchanges in the world, will be delisting 20 spot trading pairs starting January 2024. Among the listed tokens are privacy-focused cryptocurrencies, including Monero ($XMR), Zcash ($ZEC), and Dash ($DASH). OKX has offered no reason for the delisting, other than vague references to user feedback and mentioning that the delisted tokens "do not fulfill our listing criteria".

💼 Mark's Turn: Grayscale Investments announced on Tuesday that Barry Silbert has resigned as chairman of the board. Silbert's replacement is Mark Shifke, who is the CFO of Digital Currency Group (DCG), which is the parent company of Grayscale Investments. Silbert, who remains the CEO of DCG, has not made a public comment about the board change.

👨🎤 MECA: Ethereum co-founder Vitalik Buterin published a new blog post on Dec. 28th urging the web3 community to embrace crypto's cypherpunk roots, and "Make Ethereum Cypherpunk Again". Decentralization, private and secure governance, censorship resistence and credible neutrality, are among the cypherpunk values Buterin mentions, with a decreased emphasis on the overt financialization of the blockchain space.

🎅 Ho-Ho-Oh No: zkSync, an Ethereum L2 protocol focused on scaling, woke up to an unwelcome surprise on Christmas morning. According to a tweet by zkSync's official account: "one of the network's automated safety protocols was triggered by a bug in the server", crashing the network and leaving it offline for five hours.

This Week in our Blog

While some countries seem to be tightening the grips on crypto crackdowns, El Salvador and other nations are positioning themselves as crypto-friendly. "Golden" visas and passports offer crypto traders very attractive investment-based immigration opportunities. Take a deep dive with us as we explore the ins and outs of Citizenship By Investment (CBI):

NFT Market Bytes

🤝 The Art of the Deal: Former U.S. President and hopeful 2024 candidate, Donald Trump, appears to be cashing out his Ethereum, according to an Arkham report. According to Arkham, a blockchain intelligence platform, the Trump-linked wallet, which has been accruing royalty fees from Trump NFT sales, had a peak balance of $4 million before it began moving $ETH to Coinbase on Dec. 8th.

☕ K-Cups: Starbucks Korea will begin issuing NFTs starting in January, as part of the company's reusable cups initiative which encourages customers to bring their own cups to Starbucks. To incentivize people to use reusable cups for their drink orders, Starbucks will reward customers with a 'tumbler coupon' which are redeemable for free coffee drinks and special NFT awards.

🧑🌾 Max Harvest: Unsellable, a crypto startup that buys 'dead' NFTs, has been getting a lot of buzz in the CT (Crypto Twitter) community this month, as industry figures like Thomas Mancini of Floor (an NFT portfolio app) have been praising Unsellable's service. The business works similarly to stock buyback programs and allows traders to harvest tax losses.

Tweet of the Week

Celebrate the journey from #ckBTC to #ckETH with us 🎉

— DFINITY (@dfinity) December 29, 2023

It's been a year of progress, and we're grateful for the support of our incredible community

Embark on the next chapter👇https://t.co/QqTRD9GO5U 🚀

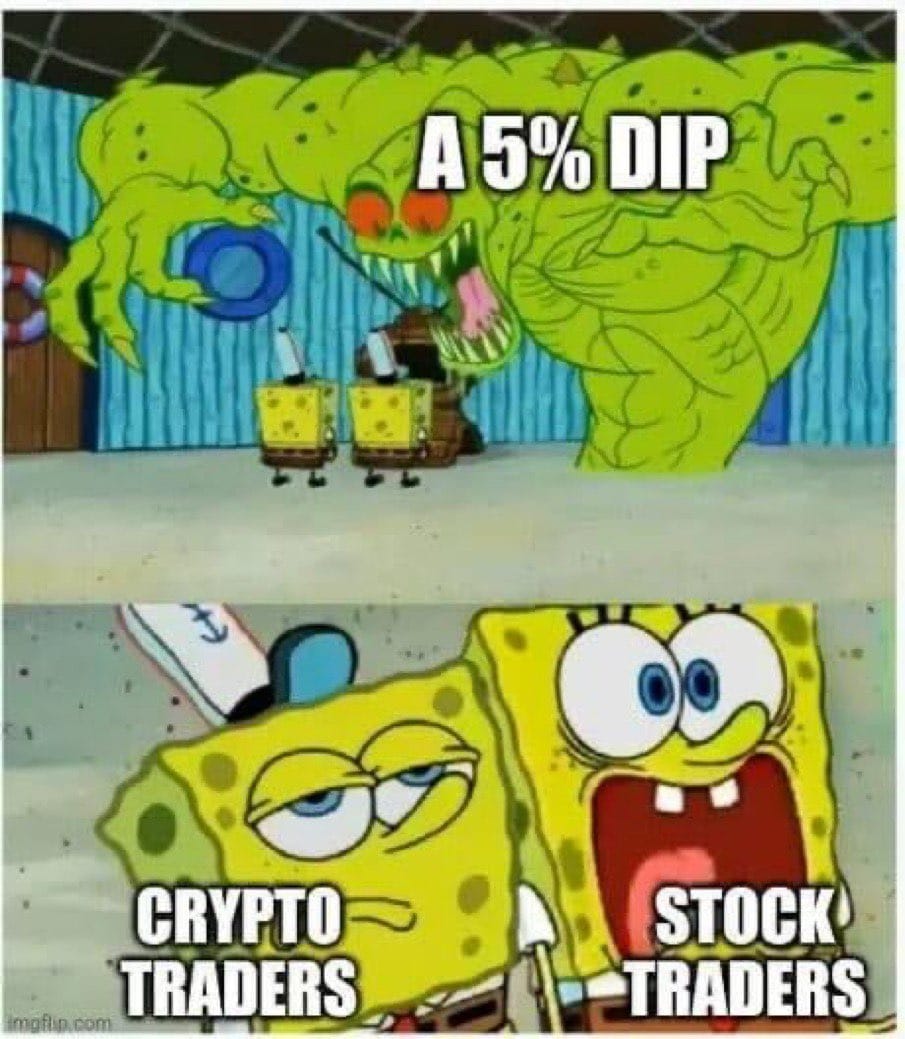

Meme Time

A Matter of Opinion

It's impossible not to reflect on the whirlwind that was 2023 as we bid farewell to another year in crypto. From major hacks to Sam Bankman-Fried's trial, Ordinals, and heated speculation about institutional plays like the Bitcoin and Ethereum ETFs, 2023 was a rollercoaster year of both triumph and turbulence.

Casey Rodarmor's Ordinal theory created renewed interest in the Bitcoin ecosystem, which had long been maligned by the rest of the crypto community as simply a gang of 'laser-eyed' maxis, holding onto what many considered outdated technology. Ordinals protocol reinvigorated traders, builders, and artists alike, leading this year's slow rising rally in both NFTs (or 'Ordinals', as they're called on Bitcoin) and meme tokens across all chains.

Regulatory concerns continue to plague the horizon. MiCA in the European Union casts a shadow of uncertainty, the SEC and Gary Gensler in the United States still stand as adversaries to mainstream adoption (despite positive expectations for the outcome of Bitcoin and Ethereum ETF filings), and both China and Korea seem no closer to easing their currently restrictive stances on digital assets.

Yet despite these challenges, the outlook seems positive by all observable sentiments. Creatives, even major fashion houses like Gucci and Louis Vuitton, have forayed deeper into NFT technology, offering novel authentication methods and exclusive experiences for luxury customers. And despite the video game industry's reluctance to embrace blockchain innovation, web3 native games like Parallel and Open Season are finding themselves integrated onto traditional, web2 video game platforms, suggesting that the walls of resistence are weakening.

What do you think we can expect to see in 2024? One thing is for sure, Bitfinity will continue to be here, innovating and striving to provide the best, seamless multi-chain experience for everyone in web3.

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: While every effort is made on this website to provide accurate information, any opinions expressed or information disseminated do not necessarily reflect the views of Bitfinity itself. The information provided here is for general informational purposes only and should not be considered as financial advice.

Comments ()