Venture Capital 2.0: The Evolution of VC in the Age of Crypto

An in-depth look at how venture capital is adapting to the world of Web 3.0, the differences between traditional VC and crypto VC, major players, and what VCs look for when investing in blockchain startups.

The venture capital (VC) landscape has been adapting with its time. Many became stupidly rich, others went bankrupt and to jail for cooking numbers. In this article we try to grasp the significance of venture capital in Web 3 and understand why this space attracts so many brave, greedy souls like those of the venture capitalists.

What is Web 3.0 Venture Capital?

Web 3.0 venture capital refers to venture capital firms that focus on seizing investment opportunities in Web 3.0 technologies, although this does not mean these venture capitalists are completely different. It is their focus and approach that will be different.

Their focus will relate to all that encompasses blockchain, which is quite a long list including DeFi, NFTs, GameFi, SocialFi, DePin, DeSci, ReFi, and many more. Additionally, exchanges or marketplaces that offer these new blockchain-based products in all their forms are also a focus for this risk-taking capital.

What the Web 3.0 venture capital firms provide is the funding for startups in the categories mentioned above.

Difference Web 3.0 and Web 2.0 Venture Capital

One of the key differences lies in the type of projects they invest in. Web 2.0 venture capital typically involves more established companies with trackable revenues and numbers.

In contrast, Web 3.0 venture capital often judges and rates companies on different aspects, since basing investments off their revenues or unit economics is often not possible. Instead, investments are often made based on the vision of the project and its potential impact.

Although many of the big venture capitals that made money in crypto have done it well before, the approach is different. Let's compare the two:

- Fundraising process: In the Web 3.0 ecosystem, fundraising is done through decentralized finance (DeFi) protocols, or via initial coin offerings (ICOs) and initial exchange offerings (IEOs), in contrast to the traditional pitch meetings.

- Valuation and ownership structure: Traditional venture capital-backed companies usually have a centralized ownership structure, with the VC firm at the top of the pyramid. This is not the case when there is a decentralized ownership structure, and the project is also at the mercy of its community and large token holders.

- Investment focus: Traditional venture capital invests in the equity of companies, not with Web 3.0 venture capital, that primarily invests in tokens.

- Community involvement: Web 3.0 venture capital firms often have to engage more publicly. This makes them questionable and lets them be criticized more easily by all on chain detectives that lurk on the blockchain 24/7. The discretion traditional venture capitals had is gone.

- Liquidity: Traditional venture capital investments are most of the time illiquid, meaning their stake of equity is not easily sold or exchanged for cash. In the case of Web 3.0, these funds have the possibility to liquidate at any moment, if the market depth permits it of course.

How Has the Structure of Venture Capital Changed by Web 3.0?

Collaboration appears to be the new norm in the VC world, with multiple investors, large and small and worldwide, chipping in together on investments. Gone are the days when a single VC would take over the entire funding round.

The scalable environment that Web 3.0 provides is because most of its offerings are software and online. This shortens the time for a possible return on investment and the VCs can hope for quicker returns. This way they are able to exit their investment within two to four years, unlike the eight to ten years typical in traditional VC.

Lastly, the frameworks for their due diligence and risk assessment need to be on point, especially with the boom and bust cycles of this highly volatile space and on top of that the extra risks of misuse of exchanges, protocol owners, hackers, and errors in the code, which makes this a highly risky investment space.

How Does Investing in Equity Differ from Tokens?

One of the biggest differences in this playfield for large capital managers is the investment in tokens, instead of investing in equity directly.

Back in the day, equity represented ownership in a company, and a right to a share of the company's profits and a say in its decision-making processes. Tokens do not necessarily pair legal rights or direct equity with the company behind it.

On top of that, equity tokens are regulated by securities laws and represent ownership. In crypto, regulators are still not sure what securities are and what not, so the issuing of these tokens for large amounts of capital can be rendered useless if regulators crack down. The fear looms that if they are not regulated, they may not count as investments.

While some VCs have their own agenda, making more money, they can use their token stack to influence decision making, not like they are used to, by sitting on the board and pulling the strings, but by voting for new updates on the project via blockchain governance.

Also we see now that he who controls the most tokens can control the markets. And many stories of VCs dumping on retail prove this trend. By doing using their tokens, they can apply pressure and have control on the future of projects.

Venture Capital That Made it Big in Crypto

Pantera Capital

Pantera Capital is an American hedge fund specializing in cryptocurrency investments. Founded in 2003 by Dan Morehead and co-managed by Joey Krug, founder of major Ethereum project Augur, Pantera launched the first U.S. crypto fund in 2013 when bitcoin was $65. As of September 2022, Pantera Capital managed $3.3 billion in assets.

Paradigm

Paradigm Capital is an investment firm focused on crypto. It was founded in 2018 by Coinbase co-founder Fred Ehrsam and Matt Huang, former partner of Sequoia Capital. Some of Paradigm's most high-profile investments include FTX, Coinbase, BlockFi, Maker, Uniswap, and Sky Mavis.

Coinbase Ventures

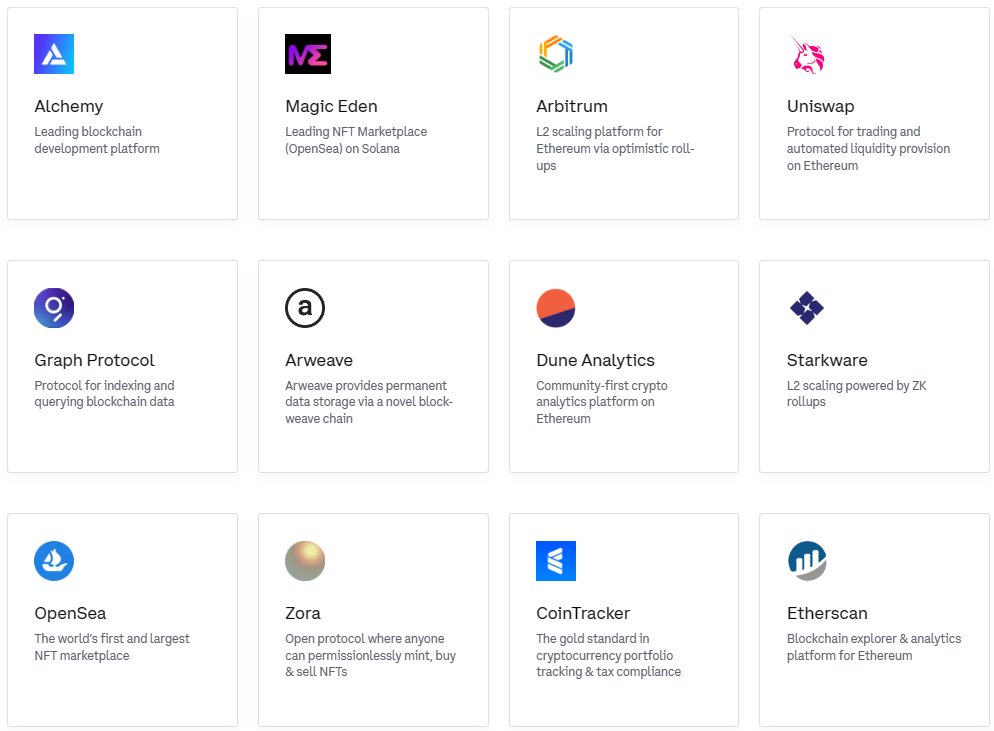

Coinbase Ventures is the venture capital arm of American crypto broker Coinbase. It has invested in hundreds of teams building everything from layer 1 protocols, Web 3.0 infrastructure, centralized on-ramps, decentralized finance, NFTs, metaverse technologies, developer tooling, and more. Notable investments include OpenSea, Compound, Uniswap.

a16z – Andreessen Horowitz

a16z, also known as Andreessen Horowitz, is a venture capital firm that has a strong presence in the crypto venture capital space, with a focus on innovative blockchain technology and early-stage investments.

The firm has $35B in assets under management across multiple funds. a16z was already a major VC firm before entering crypto, with successful pre-crypto investments including Twitter, Qik, GitHub, Pinterest, LinkedIn, and Facebook.

Venture Capital that went Bust in Crypto

Three Arrows Capital

Three Arrows Capital (3AC) believed in their own ‘Zhu’per cycle thesis but went bust after the implosion of Terra Luna vaporized their ‘venture’ capital. The firm went bankrupt in 2022, with founders Kyle Davies and Su Zhu facing heavy criticism - one now in prison and the other in an undisclosed location as they have yet to make lenders whole.

The liquidators are seeking to recover $1.3 billion from the co-founders, alleging that they took on additional debts in the months before the firm's collapse, even though it was already insolvent.

Digital Currency Group

Digital Currency Group (DCG) is a venture capital company focusing on the digital currency market and was founded in 2015 by Barry Silbert. DCG has been a prolific investor in the crypto industry, but not without its fair share of controversy and scandals.

The firm owns CoinDesk (a leading media, research, and events platform), Genesis (an institutional lending and brokerage firm), Grayscale (the largest digital currency asset management firm), and others.

Genesis, a subsidiary of DCG, filed for bankruptcy in January 2023 after halting withdrawals following the collapse of FTX. But it goes deeper than this, as Genesis, Grayscale, and DCG are all connected in forming a scheme that is similar to the scam of FTX. For a detailed explanation, check out this Twitter thread.

1/ There was a much more important fraud than SBF's embezzlement that took place in 2022. It was a fraud (allegedly) perpetrated by one of the oldest companies in the space, @DCGco and its CEO, @BarrySilbert.

— Vijay Boyapati (@real_vijay) November 6, 2023

Time for a thread 👇

More info on this scandal and fraud will definitely come out in lawsuits that will follow in the future, which will give us a clear visual of what happened and how these big players wrecked themselves.

What Do VCs Look for When Investing in Blockchain Startups?

VCs have an eagle eye for opportunity and they think most of the time cleverly before jumping in. So their first check is to look if the team behind the project are good community builders and understand Web 3.0. VCs are looking at the enhancement of the network effect of the ecosystem they're building, because community is the most important factor in this niche.

Also, they are on the lookout for founders who are obsessed with solving problems and have a bias towards action. These are the founders who are not only passionate about their projects but also proactive in building solutions. Usually people who have experienced failure, learned from it, and are coming back strong to tackle big challenges ahead.

Traditional methods of evaluating startups and equity investments may not always be applicable to Web 3.0 founders and their businesses, but VCs still need to see an exit plan, analyses on the market and margins, and the metrics of the specific business model.

Web 3.0 Crowdfunding the True Definition of Crowdfunding

But what if projects don't want or simply can't rely on the quick and big capital, VCs can offer? Well crypto enables the true version of crowdfunding, as it allows startups and projects to raise funds directly from a broad base of individuals (you and me) rather than solely relying on a small number of (institutional) investors. This idea taps directly into the "wisdom of the crowds", when they fund ideas that the public really supports. Although this wisdom of the crowds is sometimes more than debatable.

The far reaching global reach of the markets and international players open up access to (much) capital for more money seeking founders, beyond just those well-connected to VC networks. Anyone can launch a crowdfunding campaign and how many dollars he can gather in the process.

Conclusion

The venture capital industry that hasn't had to change in the last 10-20 years, now has to pivot in its approach to identify Web 3.0 possibilities and invest in potential very big returns. But in this highly risky and volatile industry we call home, is the average venture capitalist really a better portfolio manager and researcher than an onchain ape? The future will decide who makes it big and who fails even bigger in the venture capital industry.

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: While every effort is made on this website to provide accurate information, any opinions expressed or information disseminated do not necessarily reflect the views of Bitfinity itself. The information provided here is for general informational purposes only and should not be considered as financial advice.

Comments ()